Looking ahead, investors like ourselves are struggling to find parallels to the current set-up (war, inflation, interest rate hikes, oil shock) in our living investing memories. The world and markets have dramatically changed since late 2021 when central banks, woefully behind the curve, begun to react on inflation.

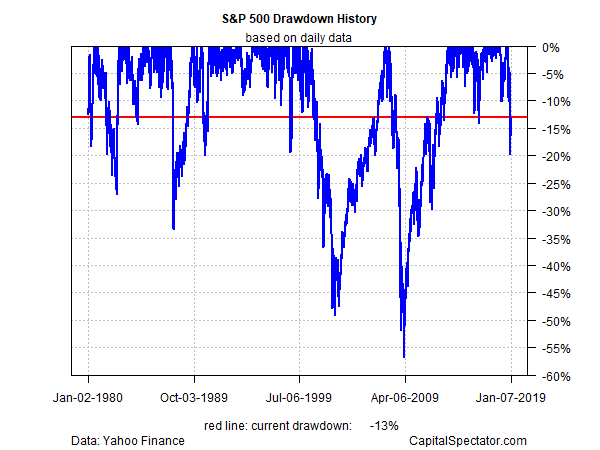

The last bull market was also a period where interest rates consistently fell and liquidity was ample – distorting the risk-return of bonds and some parts of the equity market (such as high growth tech stocks). This is especially the case for low net/market-neutral strategies which have limited beta, or market, exposure. Long short equity fund benchmarks are often based on cash rates as opposed to other risk asset benchmarks. But the comparison needs to take account of risk-adjusted returns, capital preservation in periods of stress and minimal correlation. It is, of course, untrue to say that hedge funds have outperformed traditional 60/40 portfolios in the past bull market they have not. It is in difficult market environments like this that low net equity long short hedge funds can be a successful source of diversification. Long short funds can offer minimal market exposure The problem with this today is that the yield on cash after inflation is currently extremely negative and inflation has now reached high single digits in the western world. “Cash is king” is often a term bandied around in bear markets, and it is often true. that asset prices reflect all available information) is over. For this reason, it is difficult for us to assume that this challenge to the efficient market hypothesis (i.e. Central banks are draining liquidity, rather than flooding the markets with it as the quantitative easing experiment is, perhaps, drawing to a close. We are already seven months into the current drawdown with no let-up.Īlongside ZIRP, what is also different now compared to the GFC is that inflation is much higher. In the US during the GFC, the 60/40 US Index fell for nine months, but this was primarily the equity and corporate bond side.

The drawdown in global government bonds is the largest in annualised terms since 1865, according to Bank of America, and can be directly attributed to the base level we are coming from due to Zero Interest Rate Policy (ZIRP). What is notable to us in this current sell-off in everything except the US dollar (even commodities are feeling the brunt of late), is how long the current dislocation in sovereign bond markets is lasting.

Rate rises from ultra-low base exacerbate market distortions

0 kommentar(er)

0 kommentar(er)